Navigating Inflation Trends: Impact on Compensation and Benefits for HR Professionals

Navigating Inflation's Impact on Compensation and Benefits: Strategies for HR Professionals

Introduction: Navigating Inflation Trends: Impact on Compensation and Benefits for HR Professionals

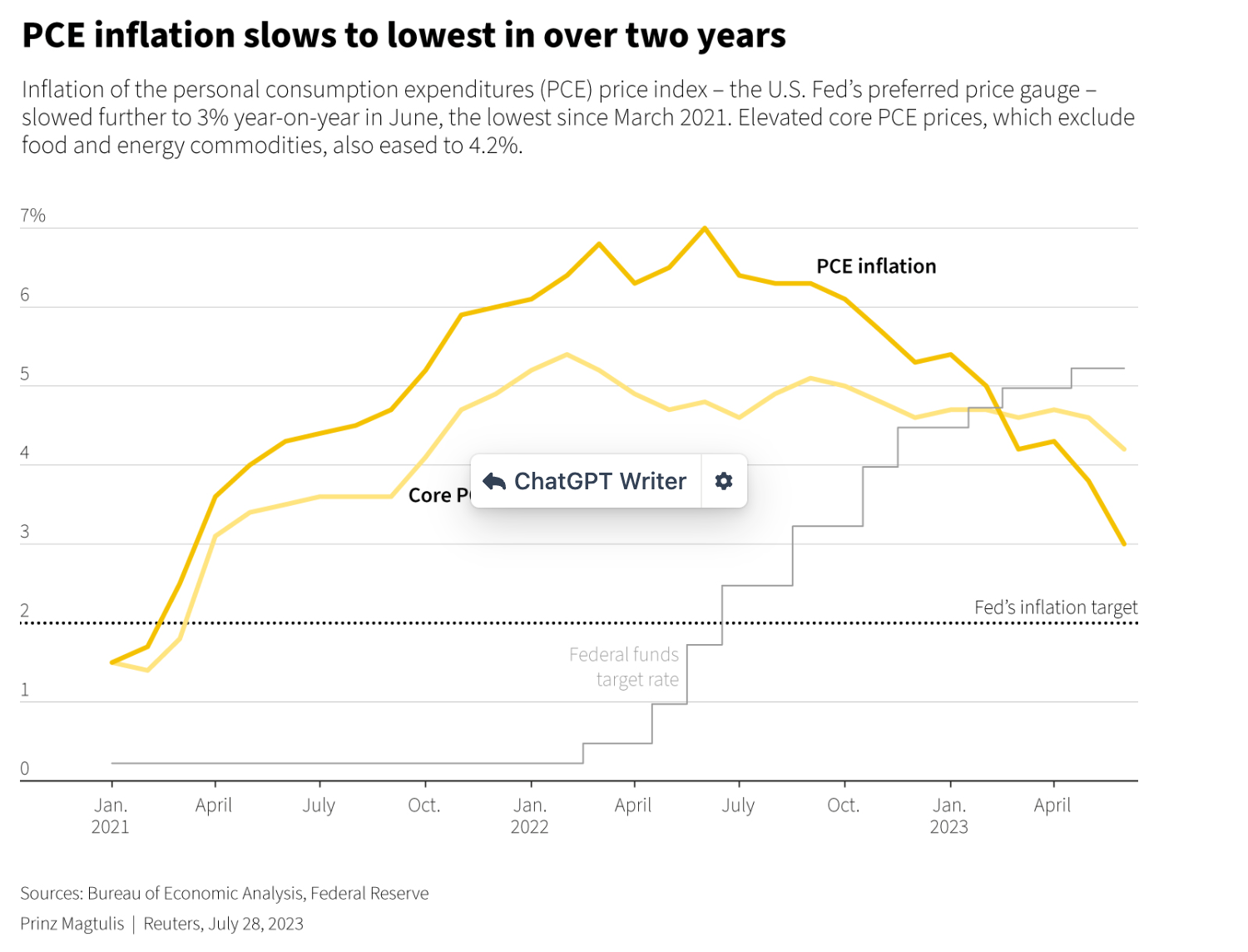

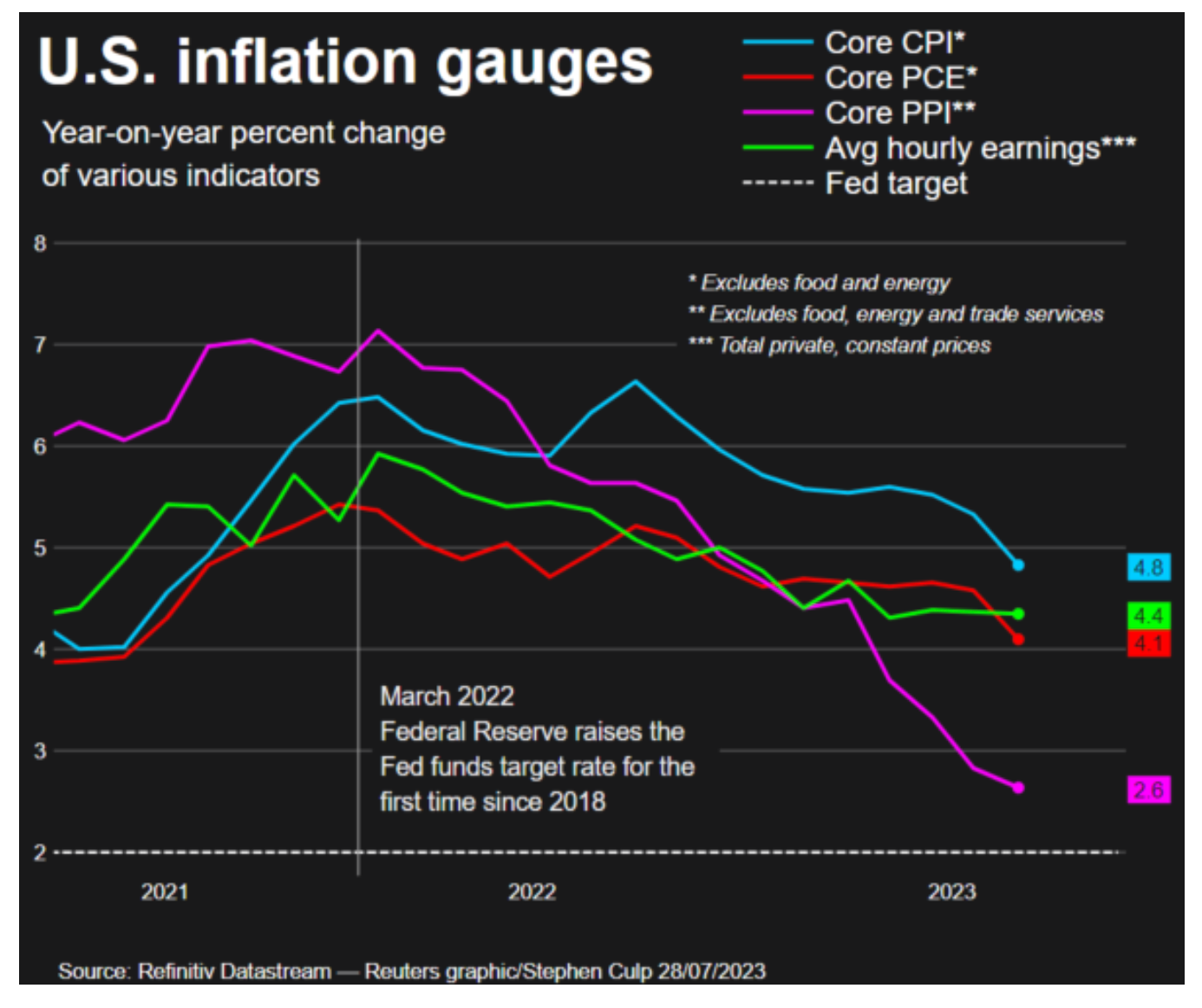

In today's rapidly evolving economic landscape, HR professionals play a pivotal role in shaping the workforce's well-being and ensuring the organization's sustainable growth. As highlighted in the recent article by Lucia Mutikani, "US annual inflation posts smallest rise in more than two years" (Reuters, July 28, 2023), staying informed about inflation trends is crucial for HR professionals. The data revealed that annual U.S. inflation rose at its slowest pace in more than two years in June, with underlying price pressures receding. This trend has significant implications for compensation and benefits management, making it essential for HR practitioners to be proactive in addressing the potential impact on employees.

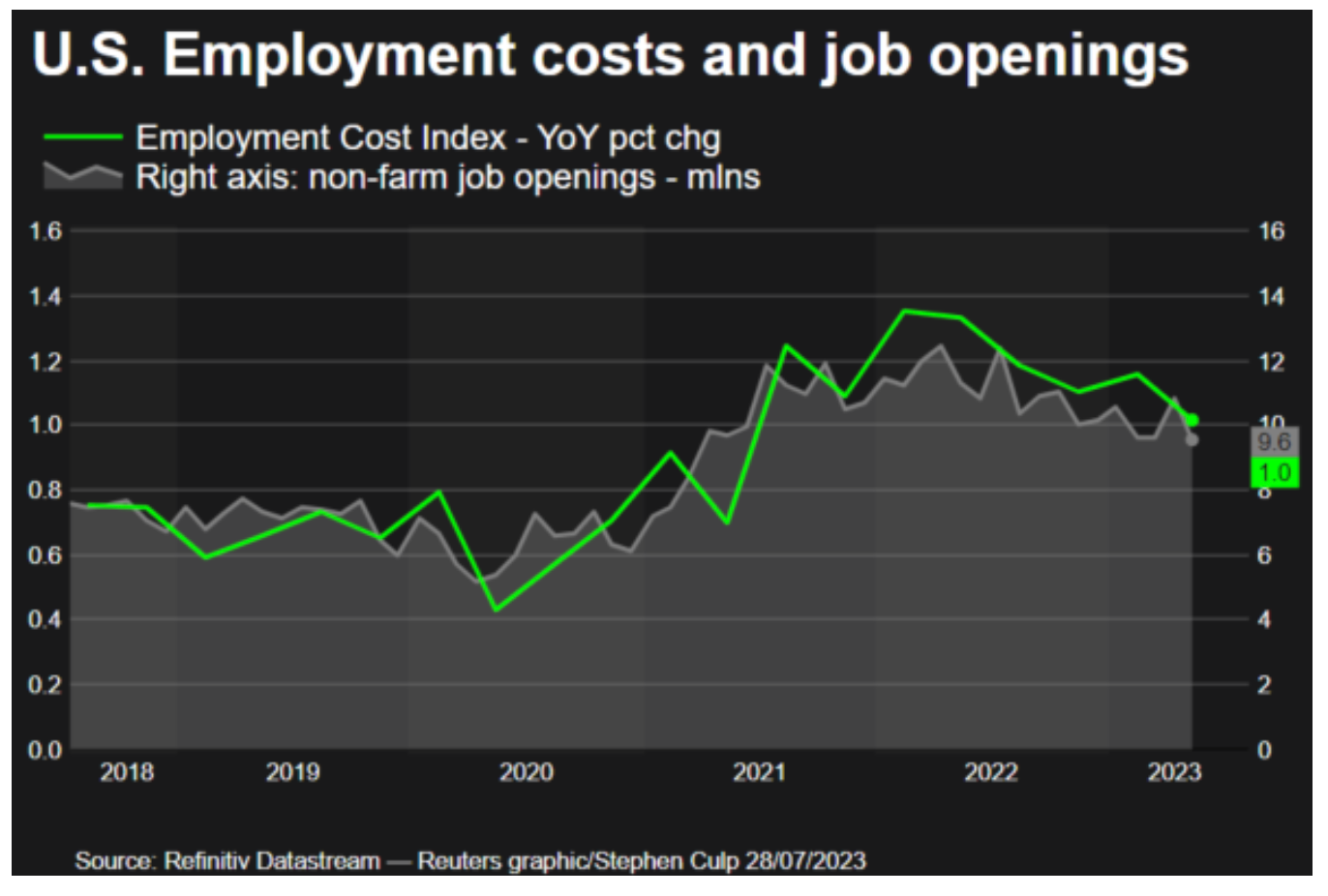

As inflation remains a critical economic indicator, HR professionals must understand its implications to navigate compensation and benefits effectively. Inflation influences the cost of living, which directly affects salary adjustments, benefits packages, and cost-of-living adjustments (COLA) for employees, particularly during high-inflation periods. By closely monitoring inflation trends and adopting strategic measures, HR professionals can ensure the financial well-being of employees and maintain a competitive advantage in the talent market.

In this blog, we will explore the intersection of inflation trends and its impact on compensation and benefits. We will delve into how HR professionals can proactively respond to economic fluctuations and manage the workforce's financial wellness. From understanding the relationship between inflation and COLA to leveraging technology for benefits administration, this comprehensive guide will equip HR practitioners with the knowledge and tools needed to navigate the complexities of compensation and benefits management in dynamic economic conditions.

Join us as we uncover the key strategies to mitigate the effects of inflation on employee compensation and benefits, ensuring that your organization remains resilient, competitive, and attuned to the financial needs of your valued workforce. Let's delve into the critical realm of inflation and its implications for HR professionals on the journey to fostering a thriving and engaged workforce.

Understanding the Impact of Inflation on Compensation and Benefits

As HR professionals, comprehending the impact of inflation on employee compensation and benefits is essential for making informed decisions that promote financial well-being and retain top talent. Inflation erodes the purchasing power of money over time, leading to an increase in the cost of living. Consequently, employees may face rising expenses for everyday necessities, such as housing, groceries, healthcare, and transportation. In this section, we will explore how inflation affects various aspects of compensation and benefits:

1. Salary Adjustments: Inflation can influence salary adjustments, as organizations must respond to rising living costs to retain a competitive edge in the job market. During periods of high inflation, failing to adjust salaries accordingly can lead to decreased employee morale and potentially high turnover rates. HR professionals must work closely with management and finance teams to implement fair and transparent salary adjustments that align with economic realities.

2. Benefits Packages: Inflation can also impact the cost of providing benefits packages to employees. Healthcare expenses, for instance, may increase due to inflation in the medical industry. Moreover, HR professionals may need to reassess retirement plans, disability insurance, and other benefits to ensure they remain viable and valuable to employees. This may involve negotiating with benefit providers and exploring cost-effective alternatives to maintain comprehensive benefits packages.

3. Cost-of-Living Adjustments (COLA): COLA is a vital component of compensation planning that aims to protect employees from the effects of inflation. COLA is typically calculated based on inflation rates and is intended to maintain the purchasing power of employees' wages. HR professionals must keep a close eye on inflation data and work closely with finance teams to determine appropriate COLA percentages to safeguard employee income against rising living costs.

4. Talent Acquisition and Retention: Inflation can influence the overall cost of talent acquisition and retention. As the cost of living rises, employees may seek higher salaries and better benefits to meet their financial needs. Attracting and retaining skilled professionals may become more challenging during periods of high inflation, necessitating creative approaches to compensation and benefits to stay competitive in the job market.

As the inflation landscape evolves, HR professionals must proactively analyze the implications and respond with well-designed compensation and benefits strategies. By staying informed about economic trends and collaborating with relevant stakeholders, HR practitioners can ensure that their organization remains resilient in times of economic fluctuations. In the next section, we will explore effective strategies to mitigate the impact of inflation on compensation and benefits, fostering a financially secure and engaged workforce.

Strategies to Mitigate the Impact of Inflation on Compensation and Benefits

To navigate the challenges posed by inflation and its influence on employee compensation and benefits, HR professionals can implement proactive strategies that promote financial stability and support the well-being of their workforce. By adopting a multi-faceted approach, organizations can mitigate the impact of inflation and create a compensation and benefits framework that aligns with the evolving economic landscape. Let's delve into some effective strategies:

Conduct Regular Compensation Reviews: Regularly review and benchmark compensation packages against industry standards and regional inflation rates. Conducting thorough compensation analyses will help identify gaps and opportunities for adjustment, ensuring that employees' salaries remain competitive and reflect the current cost of living.

Implement Flexible Benefits: Offer flexible benefits packages that allow employees to customize their benefits to suit their individual needs. Providing choices such as healthcare plans, retirement options, and other perks empowers employees to select benefits that align with their financial priorities, promoting a sense of financial security.

Enhance Financial Education Programs: Offer comprehensive financial education and wellness programs to equip employees with the knowledge and skills to navigate inflationary periods effectively. These programs can include budgeting workshops, investment seminars, and resources on managing personal finances during economic fluctuations.

Consider Variable Pay Structures: Consider incorporating variable pay structures, such as performance-based bonuses and incentives, that reward employees for exceptional contributions. Variable pay can provide a level of protection against inflation, as it allows organizations to allocate resources more strategically based on business performance.

Prioritize Employee Engagement and Communication: Transparent and open communication about compensation and benefits can foster trust and understanding among employees. Regularly communicate updates on COLA adjustments, benefit changes, and the organization's commitment to mitigating the impact of inflation on employees' financial well-being.

Focus on Total Rewards: Adopt a holistic approach to total rewards that encompasses not only monetary compensation but also non-monetary benefits, recognition programs, work-life balance initiatives, and career development opportunities. A comprehensive total rewards strategy can enhance employee satisfaction and loyalty, reducing the risk of turnover during inflationary periods.

Leverage Technology: Utilize HR technology solutions that streamline compensation and benefits management, making it easier to adapt to changing economic conditions. Automated systems can facilitate data-driven decisions, provide real-time insights into workforce compensation, and optimize benefits administration.

Monitor Market Trends: Continuously monitor economic trends, inflation rates, and industry-specific developments to anticipate potential challenges. Staying informed about market shifts will enable HR professionals to respond promptly and proactively to changes in the economic landscape.

By proactively implementing these strategies, HR professionals can create a compensation and benefits framework that is agile, responsive, and supportive of employees' financial well-being during periods of inflation. Embracing innovative solutions and engaging in collaborative discussions with key stakeholders will position organizations to thrive despite economic fluctuations. As we move forward, the ability to adapt and evolve compensation and benefits practices will be crucial in securing a motivated, engaged, and financially secure workforce. In the final section, we will summarize the importance of addressing inflation's impact on compensation and benefits and emphasize the role of HR professionals in safeguarding employees' financial welfare.

The Role of HR Professionals in Safeguarding Employees' Financial Welfare

As the guardians of an organization's most valuable asset – its workforce – HR professionals play a pivotal role in safeguarding employees' financial welfare, particularly in the face of inflationary pressures. The strategies outlined in the previous section serve as a foundation for HR professionals to proactively address the impact of inflation on compensation and benefits. By taking a proactive approach, HR professionals can position their organizations to weather economic fluctuations while supporting the financial well-being of their employees.

Advocating for Employee Financial Security: HR professionals can champion initiatives that prioritize employee financial security and well-being within the organization. This includes advocating for competitive compensation, benefits packages, and cost-of-living adjustments that reflect the impact of inflation on employees' day-to-day expenses.

Providing Data-Driven Insights: Armed with compensation analysis, market data, and economic trends, HR professionals can provide valuable insights to organizational leaders. Data-driven recommendations enable informed decision-making and allow organizations to remain competitive in attracting and retaining top talent during inflationary periods.

Cultivating a Culture of Financial Wellness: HR professionals can partner with internal stakeholders, such as finance and leadership teams, to cultivate a culture of financial wellness. This involves offering educational resources, workshops, and personalized guidance to help employees make informed financial decisions that align with their long-term goals.

Addressing Employee Concerns: During periods of high inflation, employees may express concerns about rising living costs and potential impacts on their financial stability. HR professionals can play a crucial role in addressing these concerns through transparent communication, actively listening to employee feedback, and providing reassurance about the organization's commitment to employee well-being.

Emphasizing Total Rewards and Employee Value Proposition: HR professionals should emphasize the organization's total rewards offerings and unique employee value proposition as a key differentiator in the job market. Highlighting non-monetary benefits, such as career development opportunities and a positive work environment, can reinforce the organization's commitment to employees' overall well-being.

Embracing Continuous Improvement: Inflationary periods present opportunities for HR professionals to continually assess and improve compensation and benefits strategies. Regularly gathering employee feedback and conducting internal assessments can identify areas for enhancement, leading to a more resilient and agile approach to managing compensation and benefits during economic fluctuations.

Navigating Compliance and Regulatory Changes: HR professionals must stay informed about any regulatory changes or legal implications related to compensation and benefits during inflationary periods. Adhering to compliance requirements ensures fair and equitable treatment of employees and protects the organization from potential legal risks.

Navigating Inflationary Periods with Resilience and Agility

Inflationary periods present unique challenges for organizations and their HR professionals. As the cost of living rises and economic dynamics shift, HR professionals must exhibit resilience and agility to adapt their compensation and benefits strategies effectively. This section delves into key considerations and best practices for HR professionals to navigate inflationary periods and ensure their organizations remain competitive and supportive of their workforce.

Conducting Regular Compensation Benchmarking: HR professionals should conduct regular compensation benchmarking to stay abreast of industry standards and market trends. Comparing compensation packages with competitors and conducting salary surveys will provide critical insights into whether the organization's offerings are competitive and aligned with the prevailing economic conditions.

Implementing Flexible Compensation Structures: During inflationary periods, rigid compensation structures may hinder an organization's ability to respond promptly to changing economic conditions. HR professionals should consider implementing flexible compensation structures that allow for variable pay adjustments based on economic indicators and performance metrics.

Evaluating Benefit Plan Designs: Benefit plans should be evaluated regularly to ensure they continue to meet employees' needs amid rising living costs. HR professionals can explore innovative benefit designs, such as cost-sharing arrangements, flexible spending accounts, and wellness programs, to address employees' evolving financial concerns.

Leveraging Technology for Compensation Management: Technology can streamline compensation management and enable HR professionals to make data-driven decisions quickly. HR software solutions that offer real-time analytics and forecasting capabilities empower HR teams to assess the impact of inflation on compensation and respond proactively.

Providing Financial Education and Support: HR professionals can collaborate with financial experts to offer educational workshops and resources that equip employees with the knowledge and tools to manage their finances effectively during inflationary periods. Providing support in areas such as budgeting, debt management, and long-term financial planning can alleviate employee stress and enhance financial well-being.

Emphasizing Performance Management: Performance management plays a critical role in linking compensation adjustments to individual and team contributions. HR professionals should ensure that performance evaluation processes are transparent, fair, and clearly tied to compensation decisions to foster a performance-driven culture.

Communicating Transparently: Effective communication is essential during inflationary periods. HR professionals should communicate transparently with employees about the impact of inflation on compensation and benefits, the organization's response strategy, and the importance of a collaborative approach in overcoming economic challenges.

Fostering Employee Engagement: Engaged employees are more likely to remain committed and motivated during uncertain times. HR professionals should invest in initiatives that promote employee engagement, such as recognition programs, career development opportunities, and employee well-being initiatives.

Monitoring Economic Indicators: HR professionals must continuously monitor economic indicators, inflation rates, and industry forecasts to anticipate changes in the economic landscape. Being proactive in responding to economic shifts will enable organizations to stay ahead of the curve in managing compensation and benefits.

Collaboration with Finance and Leadership: HR professionals should collaborate closely with finance and leadership teams to align compensation and benefits strategies with the organization's overall financial goals and objectives. This collaboration ensures that HR initiatives support the organization's long-term sustainability and growth.

As HR professionals embrace their pivotal role in safeguarding employees' financial welfare, they contribute significantly to the organization's overall success and stability. By navigating inflationary periods with resilience and agility, HR professionals not only create a supportive work environment but also position their organizations for sustained growth and prosperity. As the economic landscape evolves, the adaptability and dedication of HR professionals will continue to be instrumental in shaping a thriving future for organizations and their workforce.

Long-term Strategies for Compensation and Benefits Amid Economic Uncertainty

As HR professionals navigate the impact of inflation on compensation and benefits in the short term, it is equally crucial to develop long-term strategies that promote financial stability and employee well-being. This section explores forward-thinking approaches that HR professionals can adopt to build resilience against economic uncertainty and ensure the organization's continued success in the face of inflationary challenges.

Implementing Multi-Year Compensation Planning: Instead of reacting to inflation on an ad-hoc basis, HR professionals can implement multi-year compensation planning. By forecasting economic trends and incorporating inflation projections into compensation planning, HR teams can develop sustainable and proactive strategies for salary adjustments and bonuses.

Embracing Total Rewards: Total rewards encompass not only monetary compensation but also non-financial elements such as career development opportunities, work-life balance, and recognition programs. HR professionals should emphasize the value of a comprehensive total rewards package that enhances employee satisfaction and loyalty, even during inflationary periods.

Offering Tailored Benefits Options: Different employees may have varying financial needs and priorities. HR professionals can explore offering tailored benefits options, allowing employees to choose benefits that best align with their individual circumstances. This approach enhances the perceived value of the benefits package and supports employee well-being during inflationary times.

Employee Assistance Programs (EAPs): Employee Assistance Programs can be invaluable during economic uncertainty. These programs provide employees with access to counseling, financial planning resources, and support services, helping them navigate financial challenges and reduce stress during inflationary periods.

Leveraging Remote Work and Flexible Arrangements: Remote work and flexible arrangements have gained prominence in recent times. By embracing these practices, organizations can offer employees greater flexibility and potentially offset some of the financial burdens associated with inflation, such as commuting costs.

Regular Employee Surveys and Feedback: To ensure that compensation and benefits strategies remain relevant and effective, HR professionals should regularly gather feedback from employees through surveys and focus groups. Understanding employees' evolving needs and concerns will guide the continuous improvement of compensation and benefits offerings.

Upskilling and Reskilling Initiatives: Investing in employees' skills development is a powerful retention and engagement strategy. HR professionals can work with organizational leaders to implement upskilling and reskilling initiatives that enable employees to adapt to changing industry demands and enhance their career prospects.

Building a Diverse and Inclusive Culture: A diverse and inclusive culture fosters a sense of belonging and mutual support among employees. HR professionals should focus on cultivating an inclusive workplace that values diverse perspectives and talents, encouraging employees to remain committed and engaged during economic fluctuations.

Scenario Planning for Contingencies: HR professionals can collaborate with finance and leadership teams to conduct scenario planning exercises. Identifying potential inflationary scenarios and developing contingency plans will enable the organization to respond swiftly to changing economic conditions while safeguarding employees' financial well-being.

Continuous Learning and HR Development: HR professionals play a pivotal role in guiding the organization through economic challenges. Continuous learning and professional development opportunities for HR teams ensure that they stay informed about best practices, industry trends, and innovative solutions to address compensation and benefits challenges effectively.

By adopting these forward-looking strategies, HR professionals can build a resilient organization that thrives in the face of economic uncertainty. Navigating inflationary periods requires a long-term vision that prioritizes employee well-being, talent retention, and strategic decision-making. As HR professionals lead with adaptability, empathy, and innovation, they become instrumental in shaping a successful and sustainable future for both the organization and its workforce.

Collaboration and Communication with Stakeholders

In times of economic uncertainty, effective collaboration and communication with key stakeholders are paramount to achieving alignment and making informed decisions regarding compensation and benefits. HR professionals must engage with various stakeholders to gain insights, address concerns, and ensure that strategies are in line with the organization's overall mission and financial objectives. This section explores the importance of collaboration and communication in managing compensation and benefits during inflationary periods.

Finance and Leadership Teams: Collaborating closely with the finance and leadership teams is essential for HR professionals. Understanding the organization's financial health, revenue projections, and cost structures enables HR to make well-informed decisions about compensation adjustments and benefits offerings. Regular dialogues with these teams ensure that HR strategies align with the organization's financial goals.

Employee Representatives and Unions: If the organization has employee representatives or unions, HR professionals should engage in open dialogue with them. Discussing compensation and benefits concerns, sharing inflationary impacts, and jointly exploring solutions can foster a sense of partnership and lead to mutually beneficial outcomes.

Transparent Communication with Employees: Clear and transparent communication with employees about the impact of inflation on compensation and benefits is essential. HR professionals should proactively address concerns, explain any adjustments, and highlight the organization's commitment to supporting employees during economic challenges. Transparent communication fosters trust and mitigates uncertainties.

Compensation Committees: For organizations with compensation committees, HR professionals can collaborate with these committees to present data, insights, and recommendations on compensation adjustments and benefits enhancements. Engaging with these committees ensures that decisions are well-considered and align with the organization's compensation philosophy.

External Compensation Consultants: In some cases, organizations may engage external compensation consultants for expertise and market insights. HR professionals can work with these consultants to benchmark compensation against industry standards, assess the impact of inflation on salaries, and develop competitive compensation packages.

Government and Legal Compliance: HR professionals must stay informed about relevant labor laws, regulations, and government guidelines related to compensation and benefits. Compliance with legal requirements is crucial to avoid potential risks and ensure fair and equitable treatment of employees.

Training and Education for Managers: HR professionals should provide training and education to managers regarding compensation and benefits decisions during inflationary periods. Equipping managers with the necessary knowledge and communication skills helps them address employee concerns effectively and reinforce the organization's commitment to employee well-being.

Feedback and Pulse Surveys: Collecting feedback from employees through pulse surveys or feedback mechanisms allows HR professionals to gauge employee sentiment and understand the effectiveness of compensation and benefits strategies during inflationary times. Regular feedback loops enable quick adjustments if needed.

Performance and Merit-Based Compensation: During inflationary periods, HR professionals may consider shifting toward performance and merit-based compensation structures. Rewarding employees based on individual contributions and achievements aligns with the organization's focus on talent retention and performance-driven culture.

Agility and Adaptability: Economic conditions can change rapidly, necessitating HR professionals to be agile and adaptable in their approaches. Constantly monitoring inflation trends, employee needs, and market conditions empowers HR to respond promptly to emerging challenges.

By fostering collaboration and open communication with various stakeholders, HR professionals can navigate compensation and benefits challenges with collective insights and support. The willingness to engage in constructive dialogues, actively seek feedback, and make data-driven decisions strengthens the organization's resilience and fosters a sense of unity among all stakeholders. As a result, the organization can weather inflationary periods more effectively, ensuring that employee well-being remains at the core of its compensation and benefits strategies.

Mitigating Inflationary Impact through Flexible Benefits and Well-being Initiatives

As HR professionals navigate the complexities of managing compensation and benefits during inflationary periods, they can also explore innovative ways to mitigate the impact on employees through flexible benefits and well-being initiatives. This section highlights the importance of offering adaptable benefits packages and implementing well-being programs to support employees' financial and emotional well-being during times of economic uncertainty.

Flexible Benefits Packages: Inflationary periods can lead to rising costs of living and increased financial strain on employees. HR professionals can address this challenge by offering flexible benefits packages that allow employees to tailor their benefits to suit their individual needs. Providing choices such as flexible spending accounts, health savings accounts, and customizable insurance coverage empowers employees to manage their expenses more effectively.

Cost-Effective Benefits Solutions: Amid inflationary pressures, HR professionals can explore cost-effective benefits solutions that provide essential coverage without straining the organization's budget. Partnering with benefit providers to negotiate favorable rates and reviewing benefit offerings regularly can help optimize benefits packages to support employees while managing costs.

Financial Wellness Programs: Implementing financial wellness programs can be invaluable during inflationary periods. These programs provide employees with financial education, resources, and tools to navigate economic challenges, manage debt, and plan for the future. Empowering employees with financial literacy fosters resilience and eases financial stress.

Employee Assistance Programs (EAPs): EAPs offer confidential counseling and support services to employees facing personal or professional challenges. During inflationary times, these programs can provide a vital support system to help employees cope with stress, anxiety, and other emotional impacts related to financial concerns.

Wellness and Health Initiatives: Promoting employee wellness goes beyond physical health; it also encompasses mental and emotional well-being. HR professionals can introduce wellness initiatives such as mindfulness programs, stress management workshops, and work-life balance support to enhance employees' overall well-being.

Training on Financial Planning: Providing training and workshops on financial planning and budgeting can empower employees to make informed financial decisions during inflationary periods. Equipping employees with these skills enhances their financial resilience and improves their ability to manage economic challenges.

Employee Recognition and Rewards: In challenging economic environments, recognizing and rewarding employee contributions become even more critical. HR professionals can design recognition programs that acknowledge employees' efforts and provide non-monetary rewards that have a positive impact on morale.

Employee Surveys and Feedback: Regularly conducting employee surveys and seeking feedback on compensation, benefits, and well-being initiatives allow HR professionals to stay attuned to employee needs. Gathering insights from employees helps identify areas for improvement and informs future strategies.

Workforce Planning and Talent Management: HR professionals can engage in strategic workforce planning to align the organization's talent needs with its compensation and benefits strategies. Identifying critical skills and talent gaps enables HR to focus resources on areas that have the most significant impact on business success.

Long-Term Retention Strategies: Inflationary periods may lead to employee concerns about job security and career growth. Implementing long-term retention strategies, such as career development programs, succession planning, and growth opportunities, instills confidence in employees about their future within the organization.

By adopting a proactive and employee-centric approach to compensation, benefits, and well-being initiatives, HR professionals can alleviate the impact of inflation on employees and foster a supportive and resilient workforce. Investing in employee financial wellness, mental health, and career growth not only strengthens the organization's ability to weather economic uncertainties but also cultivates a culture of loyalty, trust, and commitment among employees. As HR professionals continue to navigate the ever-changing economic landscape, prioritizing the well-being and prosperity of their workforce remains fundamental to sustainable organizational success.

Planning for the Future: Strategic Compensation and Benefits

In this final section, we explore how HR professionals can strategically plan for the future in light of inflation trends to ensure the organization's compensation and benefits packages remain competitive and sustainable.

Conducting Market Research: Stay updated on industry salary benchmarks and benefits trends to understand how other organizations are responding to inflation. Conduct regular market research to ensure your organization's compensation packages remain competitive and aligned with industry standards.

Flexible Compensation Structures: Consider implementing flexible compensation structures that allow for adjustments based on economic conditions. This could include variable pay components, bonuses tied to performance metrics, or cost-of-living allowances to address inflationary impacts.

Inflation-Indexed Benefits: Explore the possibility of offering inflation-indexed benefits, such as COLA adjustments, to help employees cope with rising living costs. These adjustments can provide a level of financial security and demonstrate the organization's commitment to employee well-being.

Total Rewards Approach: Adopt a total rewards approach that goes beyond monetary compensation. Offer a comprehensive benefits package that includes perks like flexible work arrangements, professional development opportunities, wellness programs, and work-life balance initiatives.

Performance-Based Rewards: Tie compensation increases and bonuses to individual and team performance. Performance-based rewards incentivize employees to contribute to the organization's success and provide a fair and transparent system for recognizing top performers.

Long-Term Incentives: Consider implementing long-term incentive plans to retain top talent and encourage loyalty. Equity-based compensation or performance-based vesting options can align employees' interests with the organization's long-term success.

Benefit Communication and Education: Communicate the full value of the benefits package to employees and provide educational resources to help them make informed decisions. Employees may not fully appreciate the worth of non-monetary benefits, so effective communication is crucial.

Cost Management Strategies: Work closely with finance teams to develop cost management strategies that mitigate the impact of inflation on compensation and benefits. Explore efficiencies and cost-saving measures to ensure the organization's financial stability.

Scenario Planning: Engage in scenario planning exercises to anticipate potential economic scenarios and their impact on compensation and benefits. Develop contingency plans to respond quickly and effectively to changing economic conditions.

Regular Review and Evaluation: Regularly review and evaluate the effectiveness of the compensation and benefits strategy. Gather feedback from employees and conduct surveys to assess the overall satisfaction and perceived value of the package.

CONCLUSION: US Annual Inflation Posts Smallest Rise In More Than Two Years

Incorporating strategic compensation and benefits planning into the HR strategy enables organizations to navigate the challenges of inflation while remaining competitive and attractive to current and prospective employees. By offering comprehensive benefits, competitive salaries, and clear communication, HR professionals can build a loyal and motivated workforce that remains committed to achieving organizational goals, even in the face of economic uncertainties. As inflation trends continue to evolve, a proactive and strategic approach to compensation and benefits becomes an indispensable aspect of HR's role in driving organizational success.

In conclusion, the impact of inflation on compensation and benefits cannot be underestimated, and HR professionals play a pivotal role in addressing this critical aspect of employee well-being and organizational success. As demonstrated by the recent news on the slowest rise in U.S. inflation in more than two years, HR professionals must stay informed about economic trends and be prepared to adapt their strategies accordingly.

Inflation can significantly influence the cost of living for employees, making it essential for HR professionals to assess and adjust compensation packages to remain competitive and attract top talent. Salary adjustments, benefits packages, and cost-of-living adjustments (COLA) must be carefully evaluated to ensure they align with economic realities and meet the needs of the workforce.

Moreover, HR professionals should leverage data analysis, conduct compensation surveys, and seek employee feedback to make data-driven decisions that support a well-rounded and competitive rewards program. Collaborating with leadership and finance teams is vital in aligning compensation and benefits strategies with overall business objectives and maintaining financial sustainability.

As the economic landscape continues to evolve, HR professionals must demonstrate flexibility and innovation in their approach to addressing inflation's impact. Embracing technology-driven solutions, exploring creative rewards programs, and reevaluating inflation-indexed benefits are among the strategies that can foster employee satisfaction and loyalty.

Ultimately, the success of an organization heavily relies on its workforce's motivation, engagement, and dedication. By proactively responding to inflation trends and prioritizing employee well-being through competitive compensation and benefits, HR professionals empower their organizations to thrive in dynamic economic conditions.

As we move forward, HR professionals must remain vigilant, adaptable, and strategic in their efforts to create a work environment that attracts, retains, and nurtures top talent. By prioritizing employee compensation and benefits, HR professionals contribute significantly to the long-term success and resilience of their organizations, ensuring a motivated and committed workforce that propels the organization towards its goals.

In this ever-changing economic landscape, the role of HR professionals in addressing compensation and benefits becomes increasingly vital, cementing their position as the architects of a thriving, satisfied, and high-performing workforce. By staying informed, making data-driven decisions, and fostering innovation, HR professionals can successfully navigate the challenges of inflation and create a rewarding and sustainable work environment for employees and the organization as a whole.

The Inflation Myth and the Wonderful World of Deflation

"The Inflation Myth and the Wonderful World of Deflation" by Peter M. Linneman challenges common perceptions about inflation and deflation, offering a well-researched analysis of these economic indicators. The book demystifies the subject and explores the psychological biases that influence our understanding of inflation and deflation. It is an enlightening read for anyone interested in economics, finance, and the broader implications of these economic forces on society.

Predictably Irrational: The Hidden Forces That Shape Our Decisions

"Predictably Irrational: The Hidden Forces That Shape Our Decisions" by Dan Ariely reveals the intriguing ways our behavior is influenced by irrational factors. Through captivating examples, Ariely explores how psychological biases impact our choices, shedding light on the fascinating and often surprising reasons behind our decision-making processes.

Human Resource Management

"Human Resource Management" by Gary Dessler is a comprehensive guide that delves into the intricate world of HR practices. Exploring topics from recruitment and employee development to compensation and benefits, this book provides valuable insights into managing people effectively within organizations. With practical examples and strategic approaches, Dessler's book is an essential resource for HR professionals and anyone interested in understanding the dynamic field of human resource management.